Sector Update / Consumer Discretionary / Click here for full PDF version

Author(s): Ryan Winipta ;ReggieParengkuan

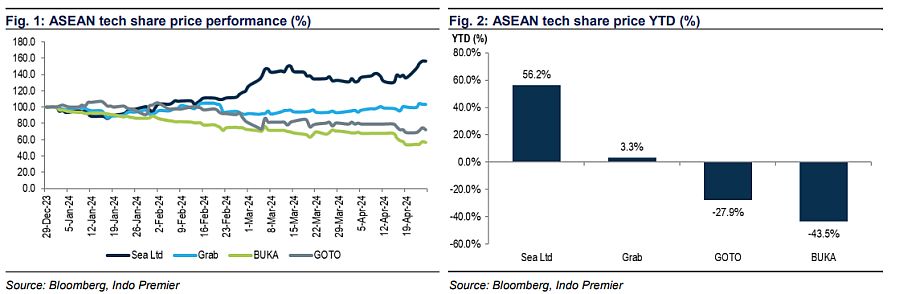

- Indonesian tech share price have declined by 28-44% on average YTD, underperforming ASEAN peers: Sea Ltd (+56%) & Grab (+3%)

- Fundamentals remain unchanged with softer 1Q24F mainly due to seasonality already priced-in into shares' underperformance.

- Improvement in fundamentals & profitability and buyback plan is a re-rating catalysts for the sector, prefer over .

Sea Ltd share price outperformed ASEAN peers; Grab flattish YTD

Sea Ltd (SE) share price was up by +56% YTD, mainly driven by strong GMV growth of US$23bn (+15% qoq, +28% yoy) and better than adjusted Adj. EBITDA loss in 4Q23, thanks to SE's focus into live-commerce initiative, and partly due to Tiktok Shop ban in Indonesia, in our view. Additionally, SE management also reiterated on possibility of re-achieving positive Adj. EBITDA by 2H24F. On the other hand, Grab share price was relatively flattish YTD (Fig. 1&2) despite announcing US$500mn buyback initiative and recording positive Adj. EBITDA positive growth since 3Q23.

Indonesian tech share price declined by 28-44% YTD

Both and share price declined by 28% and 44% YTD, respectively, despite limited changes from fundamental standpoint, aside from potential softer 1Q24F due to seasonality. For , on-demand services (ODS) GTV is likely to be softer in comparison to 4Q23, as we also observed similar trend historically with both and Grab (Fig. 3&4), especially for food-delivery. As such, we expect to record negative group Adj. EBITDA in 1Q24F due to seasonality and GoTo Logistics (GTL) still contributing negative Adj. EBITDA - as it would be de-consolidated only after 1Q24F. For , we expect 1Q24F to be the first quarter with Adj. EBITDA breakeven with buyback plan on the line after turning profitable.

Merchant rate increase will not reduce Toko/TTS aggressiveness

Recently, Tokopedia and Tiktok Shop announced an increase in merchants' commission rate by130-360bps, effective May 1st, 2024 (Fig. 5&7), which made the commission rate to be on-par with Shopee across product categories (Fig. 6).While this may optically indicate less aggressive stance from Tokopedia/TTS and lower management fee to , we tend to think otherwise, as: 1) amid live-commerce popularity, merchants' platform is already limited to Shopee or TTS, not raising merchant rate is a missed monetization opportunity, while 2) rising merchant rate also enable Tokopedia/TTS to burn more for consumer's promotion; 3) Indonesia is also set to be Tiktok Shop's biggest ex-China market with US at risk after Biden's bill on Tiktok ban and existing ban in India.

Maintain our sector Neutral rating; prefer over

We think key negatives are already priced-in by the sectors' lacklustre YTD performance; is now trading c.33% below cash level of Rp187/sh and negative EV/Sales while is trading at 3x FY24F EV/Sales, higher vs. SE but lower than Grab's 3.4x; but we estimate SE's e-commerce (ex-gaming) should be valued at least for 3.5x EV/S, meaning is trading attractively below peers. Going forward, EV/EBITDA should be used once profitability grows to take into account management fee from Tokopedia/TTS. We prefer over , on its clearer buyback pathway as have announced US$200mn buyback plan.

Sumber : IPS

powered by: IPOTNEWS.COM